The Phantom Seller's Market

|

Download this article in PDF Form

Click on the icon below

| ||||||

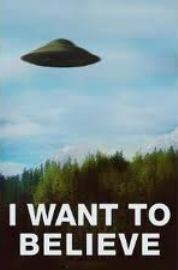

If you watched the popular 90's TV series The X Files, you may remember that Agent Mulder kept a poster on the wall of his cubicle that said, "I Want to Believe."

We all want to believe -- not in UFOs maybe -- but certainly we want to believe that the housing market is making a strong recovery.

The Wall St. Journal, quoting the National Association of Realtors and Realtor.com, reported recently that housing inventory (the number of homes listed for sale) fell to an 11-year low at the end of 2012, and dropped even further in January.

In a separate article, the WSJ, also quoting NAR statistics, reported that the U.S. median home price rose 10% to $178,900 between the fourth quarter of 2011 and the fourth quarter of 2012 -- the biggest yearly gain in the median price since the fourth quarter of 2005.

We all want to believe -- not in UFOs maybe -- but certainly we want to believe that the housing market is making a strong recovery.

The Wall St. Journal, quoting the National Association of Realtors and Realtor.com, reported recently that housing inventory (the number of homes listed for sale) fell to an 11-year low at the end of 2012, and dropped even further in January.

In a separate article, the WSJ, also quoting NAR statistics, reported that the U.S. median home price rose 10% to $178,900 between the fourth quarter of 2011 and the fourth quarter of 2012 -- the biggest yearly gain in the median price since the fourth quarter of 2005.

|

And finally, under the headline "Housing: It's Becoming a Seller's Market", the WSJ reported, " The National Association of Realtors said ... what home buyers in many parts of the United States have known for months: it’s becoming a seller’s market. ... The upshot is that there’s a growing pool of buyers chasing a shrinking supply of homes."

Realtors and mortgage originators who want to do purchase business would naturally see this as good news. Inventory has been falling for at least the last year. Home prices have been rising. It certainly does look like the beginning of a Seller's Market in real estate. Except.... |

|

Do you know what REALLY makes a Seller's Market?

Buyers!!! And that's the missing link, so far. Notwithstanding all the happy talk coming from the NAR (you can't really blame them; from their perspective it's their job to be cheerleaders for buyers and sellers), a few stubborn facts contradict the claim that we are entering (or are already in) a Seller's Market.

|

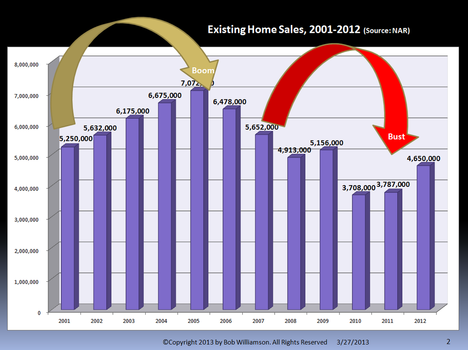

- Between 2001 and 2009, we sold an average of 5.9 million homes per year. That includes pre-boom, boom, and bust years.

- Last year (2012), we sold only 4.6 million homes -- 1.3 million homes fewer than the average over those 9 years. The current inventory is just under 2 million homes, which at the rate that homes are being sold, represents a 5 to 6-month supply.

- If we had more people actually buying homes, a lot more of that inventory would have been sold, there would probably be even more upward pressure on prices than we have actually seen (the average price for a home only went up by $11,000 in 2012 -- about 5%).

- 4.6 million Americans bought homes last year. That's nothing to sneeze at, but it is still more than a million buyers short of what we would historically consider a strong market.

|

Most of this shadow inventory will stay right where it is (i.e., not on the market) until prices rise enough to make it worthwhile for owners to sell. And that will not happen until we see a significant increase in the numbers of Buyers who are ready to buy.

Two-thirds of the inventory that did sell in 2012 was in the two lowest price brackets: $0-$100k (23.2%), and $100k-$250k (43.9%). Most of these buyers are first-time buyers and people who are returning to home ownership after having lost a home in the crash. Most of the shadow inventory would fall within the same price range.

|

Then why is inventory declining? Why don't people have more of a selection in many markets across the country?

For one thing, real estate is local. Not every market is experiencing inventory shortages, and many of those who are, don't see shortages in every neighborhood or price range. A big part of the answer is that we still have a significant shadow inventory (no one knows exactly how much) -- made up of properties held by both individual and institutional investors (and being rented for a positive cash flow), as well as homeowners who would like to sell -- but not until prices rise higher than they have so far.

|

Why aren't there more of these buyers now? It's combination of one or more of the following:

|

|

Are Buyers Really That Hesitant & Skeptical?

Don't take my word for it. MSN Money just ran an article today (April 23, 2012) under the headline, "11 Reasons to Get a Mortgage Right Now". The article lists all of the reasons you yourself might use to persuade a prospect that now is the time to purchase a home or refinance, including the likelihood that Federal Reserve supports in the form of purchases of mortgage-backed securities will end soon, that home prices are increasing, that the number of home sales is increasing, that FHA will be increasing its costs, that rents are becoming more and more expensive, that the mortgage interest rate deduction may be reduced or eliminated by Congress, that compared to renting, home ownership is more affordable virtually everywhere in the country, and that that the rate of mortgage delinquencies has declined recently – and that this will help to stabilize home values and increase homebuyer confidence.

For the most part, these are all valid points that are supported by the data. But here are the (unedited) comments posted by people who read the article:

Don't take my word for it. MSN Money just ran an article today (April 23, 2012) under the headline, "11 Reasons to Get a Mortgage Right Now". The article lists all of the reasons you yourself might use to persuade a prospect that now is the time to purchase a home or refinance, including the likelihood that Federal Reserve supports in the form of purchases of mortgage-backed securities will end soon, that home prices are increasing, that the number of home sales is increasing, that FHA will be increasing its costs, that rents are becoming more and more expensive, that the mortgage interest rate deduction may be reduced or eliminated by Congress, that compared to renting, home ownership is more affordable virtually everywhere in the country, and that that the rate of mortgage delinquencies has declined recently – and that this will help to stabilize home values and increase homebuyer confidence.

For the most part, these are all valid points that are supported by the data. But here are the (unedited) comments posted by people who read the article:

- BUYERS BEWARE! When buying a home don't forget the mainttinance cost. For example when buying a new home for $200,000 on a thirty year loan the mainttinance and remodling cost could easily run you an additional $200,000 over the thirty year loan. So whats it worth after thirty years? 200,000 + 200,000 + interest = I don't think so! And thats whats wrong with our housing market! People forget to figure in the mainttinance cost of owning a home.

- As I watch the market in my own neighborhood it is kind of interesting. Out of a neighborhood of 52 houses 5 are on the market. 4 of the 5 are small 1008 sq foot houses. (5th one is 1200 sq feet) Of the 4 that are the same size one recently went on the market. The guy bought it for 120,000.00 a little over a year ago the only thing he did to the house was put a roof on the back deck. He now has it listed for 139,000.00 while the other 3 have been on the market for not quite 2 years now at 129,000.00. Frankly I think the guy has lost his mind and it is going to be interesting to see how long it sits on the market. It is amazing to see what people think their property is worth.

- I have to agree w/batty83. Why would anyone buy a home w/layoff's still coming in wave after wave. People still don't know if they'll have a job 2 weeks from now. Can you live your life like that? NO. However, don't get caught like us. We THOUGHT we were ok. Closed on a home. 2 months later after 10 years at his job. PINK SLIP TIME! Now you all know the story. Hustling to find that job that doesn't exist anymore. Bank says "go suck an egg". Credit ruined.

- Its obviously in reference to the term length most people slave away to own a house. Then live in fear of layoffs and foreclosure in this volatile economy. If your not currently a home owner i wouldnt choose now to be one.This is my personal opininon of course...

- Hey batty83, I'd like to read 15 of your 30 reasons not to have get a mortgage at this time......As a real estate broker I concurr with the article. At least in Arizona, the wave of foreclosures has pasted with that entity only 20 per cent of the market. The supply of homes is down and prices up and climbing. That's the facts, Jack!

- yes their pushing refinance instead of home equity loans to make big fees from people,and the credit bureus are keeping everybody,s credit ratings down so you can,t even get a home equity loan and you have to refinance,what a bunch of scoundrels,greed greed greed,should be illegal,contact the whitehouse by email and raise hell

- 11 reasons to get a mortgage right now? i can give 15 or 30 reasons not to.

- Skip it.....

- Housing market, will crash again (when more foreclosed houses hit the market thus drive down prices), the financial market is not all that stable, and it is now better to rent than buy-to-own.

- Too much UNcertainty at this time. Mortgage mess is alive and well. Not to be resolved anytime soon.

- And 1 better reason not to get a mortgage right now...You do not want to be a DEBT SLAVE.

- Get OUT of debt!!!!!!!!!!!!!!!!!!!! Get OUT of debt!!!!!!!!!!!!!!!!!!!! Get OUT of debt!!!!!!!!!!!!!!!!!!!!

- What a bunch of baloney as I look at our last Thursdays newspapers with 21 pages of foreclosure listings...I've been told by Realtors who work for National companies that they have been told to basically lie, lie, lie, lie, lie, about the economy and to push up the price of any house they sell to "get the most out of the buyers". Also O'Vomit is pushing for Refi's because then you will not get as much back next April for your Mortagage deduction and O'Vomit gets to keep more of it...Also many of the Top National Companies Boards were behind the "Bundling" of millions of dollars for O'Vomit..So the dishonesty of the Demoncrats has spread like a Cancer across the Country turning so many people into dishonest liars...and cheating you...

At the time I saw this article, there were 13 comments. The one in blue was written by a real estate broker in Arizona, and was the only comment agreeing with the article. This is obviously not a scientific survey of the buying public, and clearly some of these people had poor spelling & grammar, as well as axes to grind. But for everyone who saw the article and was motivated enough to go to the trouble of posting a comment, there are thousands of people who either agree with the comments or at the very least, have serious doubts.

What Will It Take to Move More Buyers Off the Fence?

Think about all of the reasons I gave to explain why people are hesitating, even though they would like to own their own homes .

Regardless of the specific reason or combination of reasons an individual buyer may have, what's at the bottom of this reluctance to move forward?

Regardless of the specific reason or combination of reasons an individual buyer may have, what's at the bottom of this reluctance to move forward?

It's Fear.

Everyone knows that buying a home is a big decision, the biggest purchase most people will make in their lives, etc. And the bigger the decision, the greater the fear of making the wrong decision.

What conquers this kind of fear, which is largely based on people's recognition that they are dealing with forces and trends and factors that they do not completely understand?

When my granddaughter was first beginning to learn to read, she saw words on a page, and she didn't recognize most of those words. It was a bit intimidating at first, but with patience and practice, she learned to recognize these words, and learned new ones every day. Today, she loves to read, and she is reading a couple of years ahead of her grade level.

It's the same with prospective homebuyers. The fear, uncertainty, and intimidation they feel today can be overcome in time with information and education. You don't have to be a genius to understand the basic economics that underlie a decision to purchase a home. Any person with average intelligence (and a good teacher or coach) can learn to grasp these principles. Knowledge and understanding lead to confidence and decisiveness.

Everyone knows that buying a home is a big decision, the biggest purchase most people will make in their lives, etc. And the bigger the decision, the greater the fear of making the wrong decision.

What conquers this kind of fear, which is largely based on people's recognition that they are dealing with forces and trends and factors that they do not completely understand?

When my granddaughter was first beginning to learn to read, she saw words on a page, and she didn't recognize most of those words. It was a bit intimidating at first, but with patience and practice, she learned to recognize these words, and learned new ones every day. Today, she loves to read, and she is reading a couple of years ahead of her grade level.

It's the same with prospective homebuyers. The fear, uncertainty, and intimidation they feel today can be overcome in time with information and education. You don't have to be a genius to understand the basic economics that underlie a decision to purchase a home. Any person with average intelligence (and a good teacher or coach) can learn to grasp these principles. Knowledge and understanding lead to confidence and decisiveness.

How the Mortgage Industry Tries to Educate the Public

It is not a new thing for mortgage lenders to provide educational information to the public. But if you look at any number of mortgage websites, what will you find? The information on these sites explains the loan process, different types of loan products, and other arcane details of the lending business -– ratios, interest rates, locking loans, etc.

|

This is like sending information on car loans to people who aren't sure whether they want to buy a car yet -- let alone what kind of car they would buy. The kind of financing they would get if they did buy a car would be way down at the bottom of their list of things to consider.

The vast majority of potential homebuyers are on the fence precisely because they have not yet made either an emotional or rational decision to move forward with a home purchase. If they are worried about the economy or their job or the real estate market or their ability to qualify, they are the very definition of "not ready yet". You cannot reassure – let alone motivate – people like that by talking to them about interest rates or loan programs or debt to income ratios. |

There will be a time for that kind of information, but right now, these people want to learn about the pros and cons of buying a home. What are the risks? What are the benefits? What do I need to know about what is happening in my local real estate market now? Is this a good time to buy? If so, why? Given my personal finances, and my job security, and my financial obligations, and the kinds of things I expect to be happening to me and my family in the near future, how do all those things affect the rightness or wrongness --for me -- of a home purchase?

It also matters to people where they get their information from. For example, they would not expect to receive reliable, objective information about the pros and cons of Ford versus Chevy by talking to the salesperson at the Chevy dealership. They don't expect to hear about the benefits of tap water from someone who sells water purification systems. If they want that kind of information, they will look for someone they consider to be knowledgeable and impartial.

|

And people don't expect to receive objective information about whether this is a good time to buy a home from someone who makes a living selling homes. This is not a reflection on the integrity of Realtors; it just recognizes the reality that people will tend to regard such information --coming from a Realtor -- as self-serving. They will often dismiss it completely. At a minimum, they will take that information with a giant grain of salt.

|

Where Can People Get Reliable, Objective Information About

Buying a Home?

It has long been my contention that the mortgage lender is the professional who is best positioned to provide consumers with objective and reliable information about home ownership. That is because the lender is the only one who might say "No" to a transaction. Buyers know that the LO gains nothing by trying to persuade them to get a mortgage loan when they don't have the financial wherewithal and stability to pay it back. In today's regulatory and legal climate, the lender who makes a loan that goes into default ends up getting sued in a buyback claim.

Nor does it benefit the lender to push a buyer to make a higher offer on a home than the home's actual value. Today, that results in an appraisal that comes in below the purchase price, and creates frustration and wasted time for everyone involved. And buyers will understand that, especially if it is explained to them.

Buying a Home?

It has long been my contention that the mortgage lender is the professional who is best positioned to provide consumers with objective and reliable information about home ownership. That is because the lender is the only one who might say "No" to a transaction. Buyers know that the LO gains nothing by trying to persuade them to get a mortgage loan when they don't have the financial wherewithal and stability to pay it back. In today's regulatory and legal climate, the lender who makes a loan that goes into default ends up getting sued in a buyback claim.

Nor does it benefit the lender to push a buyer to make a higher offer on a home than the home's actual value. Today, that results in an appraisal that comes in below the purchase price, and creates frustration and wasted time for everyone involved. And buyers will understand that, especially if it is explained to them.

I'm not suggesting that just because you are a loan officer, you will automatically be seen as a trustworthy source of objective information. (Some of the negative comments posted to the MSN Money article that I referred to above were directed at the mortgage industry.)

You and every other loan officer will be judged individually by your audience and your market. How people respond to you will be based largely on how honest, real, and genuine you seem to be.

One thing you can be sure of: you will have no impact whatsoever until you decide to join the conversation.

You and every other loan officer will be judged individually by your audience and your market. How people respond to you will be based largely on how honest, real, and genuine you seem to be.

One thing you can be sure of: you will have no impact whatsoever until you decide to join the conversation.

Loan officers have a fiduciary responsibility to their employers, but more to the point, they also have fiduciary, ethical and moral responsibilities to their buyer clients. These responsibilities can be explained to buyer prospects, and buyers will understand, and will feel protected by that knowledge.

But what about Realtors?

The fact that you have these responsibilities to your homebuyer clients in no way means you have to be in an adversarial relationship with the Realtors in your marketplace. In fact, it's quite the contrary: the better you are at providing honest information and guidance to buyers, the more successful your Realtor partners become. Instead of wasting time on transactions that cannot close, Realtors can devote their time and energy to transactions that will close. Most importantly, a buyer who has been properly educated by the loan originator is a far more confident and decisive buyer. Such buyers will know what they want; they won't waste a Realtor's time. If you explain this to your Realtors, they will recognize the truth in it, and they will understand how you are saving them time and helping them close more transactions.

The fact that you have these responsibilities to your homebuyer clients in no way means you have to be in an adversarial relationship with the Realtors in your marketplace. In fact, it's quite the contrary: the better you are at providing honest information and guidance to buyers, the more successful your Realtor partners become. Instead of wasting time on transactions that cannot close, Realtors can devote their time and energy to transactions that will close. Most importantly, a buyer who has been properly educated by the loan originator is a far more confident and decisive buyer. Such buyers will know what they want; they won't waste a Realtor's time. If you explain this to your Realtors, they will recognize the truth in it, and they will understand how you are saving them time and helping them close more transactions.

To review:

- Right now, the most important missing ingredient for a healthier home purchase market is more Buyers who are ready to buy.

- Hundreds of thousands of consumers who would actually benefit from becoming homebuyers (or sellers and move-up buyers) are held back by fears about the market, the economy, the process, and their own personal finances.

- The solution to this impasse is objective and reliable information, education, and coaching -– delivered at the retail level -– one to one.

- Realtors, through no fault of their own, are not in the best position to provide that education and coaching.

- Mortgage origination professionals are in a position to provide the information and coaching, and are more likely to be seen as objective.

How To Be Part of the Solution

If you agree with my analysis, you can see that what this real estate market needs is more buyers. You understand that we don't have more buyers ready to buy because people are worried or indecisive about all of the factors I mentioned: the economy, the real estate market, the process of buying and financing a home, and their own personal finances. You realize that providing information and coaching to people is the best way to move them "off the fence", as long as the source of that information is considered objective and credible. And you recognize that, generally speaking, loan originators are in the best position to provide that information.

Let's say you really do want to educate potential buyers in your local real estate market. How do you go about doing that, short of dropping everything else you're doing in order to do the research, write the material, and find ways to get it out into your community?

Let's say you really do want to educate potential buyers in your local real estate market. How do you go about doing that, short of dropping everything else you're doing in order to do the research, write the material, and find ways to get it out into your community?

I coach loan officers every day; I understand the problems and challenges you face.

But – and I'm sure you already realize this – none of this is going to get any better for you if you just continue to do what you've been doing. And working harder is probably not the answer either, unless you really think your problem is that you're lazy. You can keep your nose to the grindstone only so long before you realize you no longer have a nose.

- I understand that the regulatory climate, combined with more stringent underwriting requirements (which are themselves largely caused by the regulatory climate) have made it more difficult for you to manage the loan process so that the loan closes on time and your clients (and Realtors) aren't frustrated and stressed out by the experience.

- I understand that you often have to deal with and try to satisfy demanding clients, or demanding Realtors, or both.

- I understand that you have to rely on people you don't control (processors, underwriters, appraisers, title/escrow people, Realtors, and clients) – in order to get loans done right and on time.

- I understand that you have to try to balance all of that with the need to originate business – to generate leads, create or develop referral relationships with Realtors and other referral sources, and that this part of your job alone can be incredibly time-consuming.

- I understand that when you get a lead, you often find yourself in a position where you feel you have to research the loan and prepare a loan proposal before you even know whether you really have a client and a loan that you will be able to submit. In other words, there is a process which must happen between getting a lead and having a loan to submit, and one of the challenges is that you don't really have a set process or system that you can follow in every situation. Some clients are willing to be led by you through the process; others want to direct you. This adds to the complexity of your job.

- When you do have time to try to do some marketing, you often find that you either don't have the right technology to do what you'd like to do, or you don't fully understand how to use the technology to its fullest capacity, or for whatever reason, the technology simply doesn't work the way it is supposed to.

- Most importantly, I understand that there is never enough time to do everything you have to do, let alone everything you would like to do.

But – and I'm sure you already realize this – none of this is going to get any better for you if you just continue to do what you've been doing. And working harder is probably not the answer either, unless you really think your problem is that you're lazy. You can keep your nose to the grindstone only so long before you realize you no longer have a nose.

"The journey of a thousand miles starts with a single step." Take your next step with one or more of the following options:

Option 1

Register for my next free webinar on June 6th:

Who Has Time for That? How to Build the Loan Origination Business You Want With the Time & Resources You Have

Thursday, June 6th, 3:00 PM Eastern Time (1:00 PM Pacific Time)

For Information and to Register, go here

Option 2

Schedule a free, one-hour private coaching session (for new clients only; limit one free session per person)

Option 3

Sign up for weekly, personal coaching. (Click here for information on how coaching works, what's included, etc.)

Option 1

Register for my next free webinar on June 6th:

Who Has Time for That? How to Build the Loan Origination Business You Want With the Time & Resources You Have

Thursday, June 6th, 3:00 PM Eastern Time (1:00 PM Pacific Time)

For Information and to Register, go here

Option 2

Schedule a free, one-hour private coaching session (for new clients only; limit one free session per person)

Option 3

Sign up for weekly, personal coaching. (Click here for information on how coaching works, what's included, etc.)