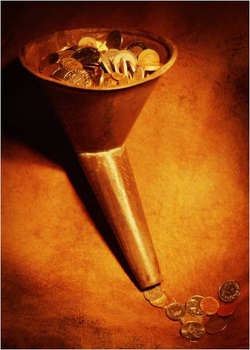

The funnel is dead. The new consumer decision journey.

Mr. Edelman explains that the funnel (referring to the traditional image of a sales funnel, where leads go in at the top of the funnel and come out at the bottom as closed sales) is an outdated concept because today's consumers take a more complex path toward, and beyond a purchase decision. Instead, he uses a model that includes the following steps in a buying decision:

- Consider: What brands/products do consumers have in mind as they contemplate a purchase?

- Evaluate: Consumers gather information to narrow their choices.

- Buy: Consumers decide on a brand and buy it.

- Post-purchase: Consumers reflect on the buying experience, creating expectations/considerations that will inform a subsequent purchase

- Advocate: Consumers tell others about the product or service they bought.

The funnel isn’t dead (may be just incomplete with today’s consumers buying decisions?) but wouldn’t it be great to get to the point of having our customers being an advocate for us post sale? That isn’t covered in the funnel nor it is thought of in our mortgage banking world…everyone focuses on branding, but branding and having your customers advocate for you are not the same. Interesting. I haven’t heard of building advocates, since Joe Stumpf, but in the social media world of today it could be a better possibility. We work on current client referrals, past client referrals and hope to build advocates, but stop short because we are so involved with the loan process that we are hopeful just to get a client referral. We only have so much time and without predictable outcomes that can lead to the building of the advocate or the time needed to build the advocate, we have lost sight of it. The predictability of our systems has left by the way of the front door.

So what is the solution? To add the necessary staffing to be sure that we are taking great care of our clients, get the LO out of the loan process and have the experts handle it (more predictable results), weekly follow-up with all parties in the transaction (the old weekly status cards), rechecking the HUD two days prior to the closing & attending the closing, a big thank you and telling the client post-closing what you are going to do for them (rate watch, annual reviews) -- ask them to be an advocate for you -- to tell everyone about the way you do your business. The personal touch. None of these things are new but I do think that we have lost sight of them when automation started and we decided (or our employers decided) that we needed to do more with less.

My thoughts on all of this ...

As you know, I have been saying for years that it isn’t a funnel, it’s a sieve (because Realtors and loan officers capture and close such a small percentage of their opportunities).

As for getting people (clients) to advocate for you, I had a conversation with a client about that a couple of days ago. These days, people rarely go out of their way to recommend a vendor (and to your loan customers, you are a vendor).

Why?

Because they are so rarely truly impressed in a business transaction. They’ll talk about you if you really screw up (read Joe Girard’s How to Sell Anything to Anybody). But most loan officers – most businesspeople – have no clue as to what it takes to rise to the level of performance where people can’t resist talking good about you (advocating for you) to their friends.

Here’s an example: if you know anybody who has recently bought an iPhone or an iPad, chances are they will brag about it, show it to you, etc. Why? Because the darn things are so different from everything else out there, and because buying one makes you feel cool.

You can send your canned loan status updates out every week (a 1990’s idea at best), but these days it’s more likely to result in people blocking your emails than it is to result in a referral.

Yes, you do have to take great care of your clients, but very often your idea of taking great care of a client is the client’s idea of “good” service – and they expect good service. It doesn’t mean they’re going to recommend you to their friends (unless maybe somebody specifically asks them for a recommendation). It does mean that if you don’t give them good service, they will complain about you for as long as it takes them to stop being ticked off at you.

It takes so much more than good (or even great) service to really impress people these days – and that is why it is so important to really stand out from your competition by doing something extraordinary – like being a great homebuyer coach in addition to being a great loan officer. For a description of what I mean by this, see my training video, "How to Succeed in This Terrible, Awful, No-Good, Lousy Market" -- especially Parts 2 and 3.

There is absolutely nothing wrong with doing the things you suggest. None of those things is going to hurt you, and if you don’t do most of them, it probably would hurt you. But it takes far more than that to really surprise and impress people today – and people only become advocates for you if you impress them -- really impress them.

RSS Feed

RSS Feed